2023Q2 (2023 Jan)

財報分析

- 損益表

- 今季的G&A增幅恐佈,上升了63%

- 由於OPEXg > REVg,所以OP下跌了8.5%

- 雲業務是MSFT的增長動力,今季收入增長17%;硬件銷售則拖慢公司增長

- 業務拆解

- Productivity & Business Process: LinkedIn及Dynamic是該segment的增長點

- Intelligent Cloud: 指的是sever product及雲服務,由Azure支持發展

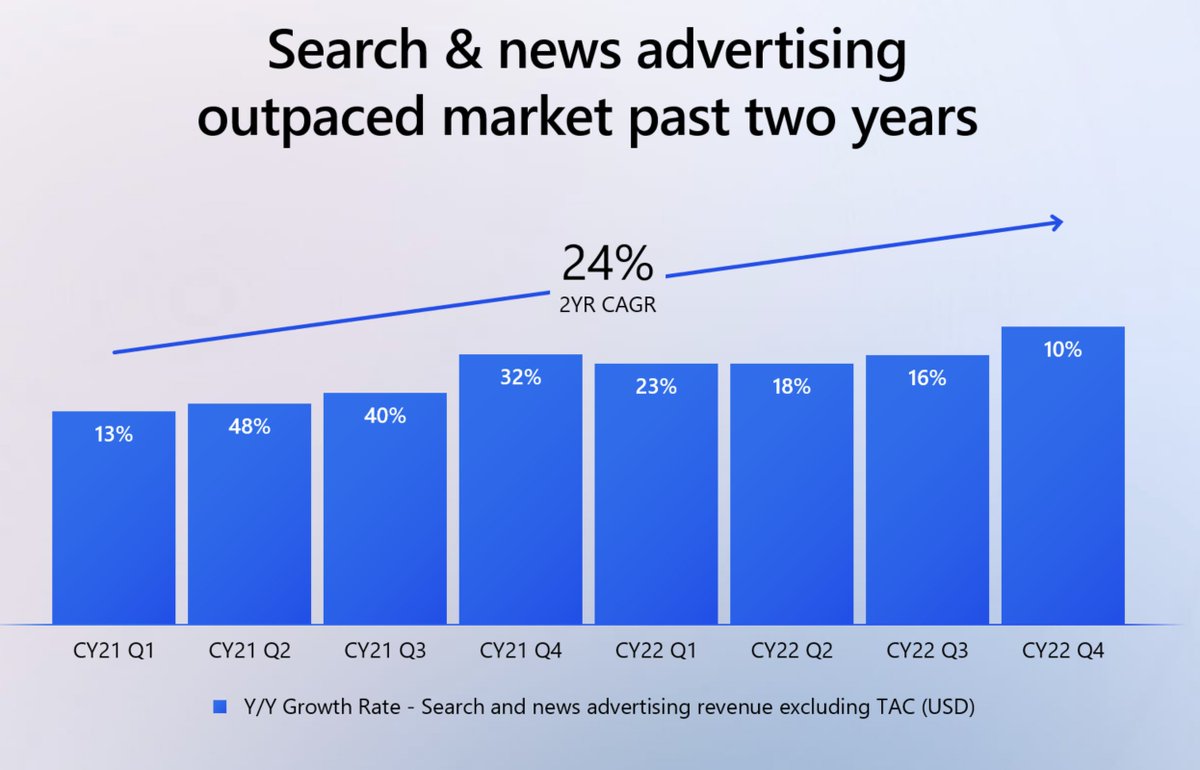

- Personal Computing: Windows OEM及手機拖累增長,但廣告收入是增長亮點

結論

- 今季的G&A增幅恐佈

- Productivity & Business Process segment我們要留意LinkedIn及Dynamic增速

- 廣告收入表現亮麗

Earnings Transcript重點

- 客戶正在減少科技相關的支出,對SaaS公司一定有影響,特別是SMEs

- 雲相關及A.I.

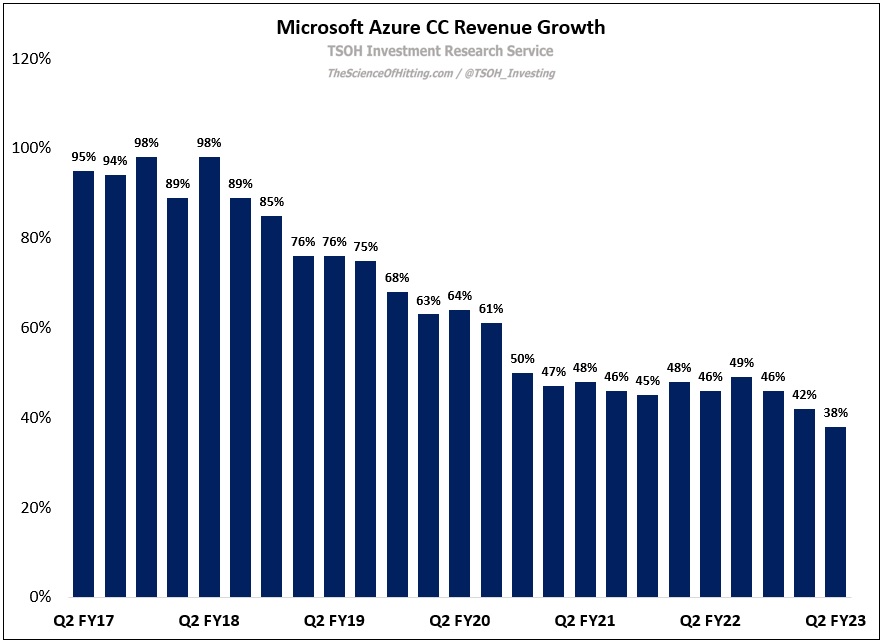

- 雲收入增長為重點(但其中的Azure增速變慢),A.I.會是未來的業務重點

- 2018年收購了GitHub,GitHub(全球最大的社交編程雲端平台,讓開發者可以儲存和管理他們的程式碼、版本控制和協作工具)可以說是A.I.的另一巨頭: 從GitHub + OpenAI (ChatGPT)的投資,看得出MSFT會在A.I.領域佔一重要位置

- Teams及LinkedIn表現理想,Office 365 renewal沒有下跌

- 雖然市場廣告支出下跌,但MSFT的廣告收入仍有10%增長,跑贏同業

- MSFT的cybersecurity收入也佔比到約10%

- Guidance: 下半年Commercial Business增速變慢

Earnings Transcript節錄

- "Just as we saw customers accelerate their digital spend during the pandemic, we are now seeing them optimize that spend. Also, organizations are exercising caution given the macro uncertainty"

- CEO clarifies on customer spend: "What we see is optimization & some cautious approach to new workloads and that will cycle through. But we do fundamentally believe on a long-term basis as a percentage of GDP tech spend is going up"

- CEO: "The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform CFO: "Microsoft Cloud revenue was $27.1B, up 22% (up 29% in constant currency) YoY"

- Microsoft 365

- We have more than 63 million consumer subscribers, up 12% year-over-year and we introduced Microsoft 365 Basic, bringing our premium offerings to more people.

- No slowdown in MSFT 365: "In Microsoft 365, what you saw was very good renewal execution... Q1 based on explorations that we'd seen a year ago. So deals are both getting done and I think getting done on time. Getting done within a discount range that we feel good about."

- Azure

- Growth moderating: "Azure & other cloud services revenue grew 31% & 38% (last Q grew 42%) in constant currency. As noted earlier, growth continued to moderate, particularly in Dec & we exited the quarter with Azure Constant Currency growth in the mid-30s" - CFO

- "..we saw results weaken through December. We saw moderated consumption growth in Azure & lower-than-expected growth in new business across the stand-alone Office 365, EMS & Windows commercial products that are sold outside the Microsoft 365 suite"

- We are still in the early innings of cloud adoption: Enterprises have moved millions of calls to Azure and run twice as many calls on our cloud today than they did 2 years ago.

- "The age of AI is upon us & Microsoft is powering it...Azure ML (machine learning) revenue alone has increased more than 100% for five quarters in a row"

- Github has $1B in ARR: "Since our acquisition, Github is now at $1 billion in annual recurring revenue and get help us developer-first ethos has never been stronger more than 90M people now use the service to build software on any platform"

- Cost savings when using cloud: Insurer AlA was able to save more than 20% by migrating to Azure and reduced IT provisioning time from multiple months to just an hour.

- Teams is still gaining traction, hits 280M MAUs: "Teams surpassed 280M monthly active users this quarter, showing durable momentum since the pandemic &... the number of third-party apps with more than 10,000 users increased nearly 40% YoY"

- LinkedIn is still growing: "We once again saw record engagement among our more than 900 million members. Three members are signing up every second. Over 80% of these members are from outside the United States"

- Search business CFO: "We have more than 1.4B monthly active Windows devices and are seeing increased engagement that is up 10% versus pre-pandemic...Most of the time spent on the PC, however, is browsing, searching, shopping & consuming the news"

- Advertising

- Microsoft's ad business is already profitable and has been growing at double-digit CAGR rates: 2 largest digital advertising businesses are search and news advertising and Linkedln Marketing Solutions. Over the last 12 months, our total advertising revenue was nearly $18 billion, and the businesses continue to be profitable.

- Ad spend taking a hit: "Additionally, customers, focusing our advertising spend will impact Linkedin and search and news advertising revenue"

- Cybersecurity now constitutes ~10% of MSFT's total group revenue

- Over the past 12 months, our security business surpassed $20 billion in revenue as we help customers protect their digital estate across clouds and endpoint platforms.

- We are the only company with integrated end-to-end tools spanning identity, security, compliance, device management and privacy informed and trained on over 65 trillion signals each day.

- Gaming:

- "we expect revenue to decline in the high single digits. We expect Xbox content &services revenue to decline in the low single digits as growth in Xbox Game Pass subs will be more than offset by lower monetization/hour in third party & first-party content"

- We saw new highs for Game Pass subscriptions, game streaming hours and monthly active devices, and monthly active users surpassed a record 120 million during the quarter.

- CEO: "Bing continues to gain share in the US..."

- Guidance: "In our commercial business, revenue grew 20% on a CC basis in H1. However, we now expect to see a deceleration in H2 given how we exited December...In H1 23, over 70% of our revenue came from our commercial business & over 70% of that from Microsoft Cloud"