【美股世界】【中級: 財報分析】【業績追踪】Paypal (update: 2022Q4)

2022Q4 (2023 Feb)

財報分析

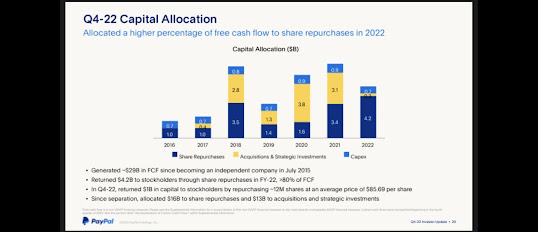

- SBC佔總收入的17%,不是低比例; 但同時在2022年回購了42億美元股份,相等於5%的市值

- 2022年OCF只是輕微上升

- Capex下跌了22%

- 在2022年經濟受考驗時,公司下調了G&A的支出,十分正面

- Non-transaction OpEx fell 6% YoY vs. double digit growth we had seen in 2021 & early 2022

- YoY EBIT, net income and cash flow margins improve

- Active Account、No. of payment transactions、TPV增長都在變慢

- 但Take Rate有在改善: 這是數年來PayPal交易佣金率連續增長兩個季度的第一次

- 交易毛利率收縮是由於交易費用增加,而交易費用增加是因為非品牌份額增加,所以是可以接受的 (Source: Transaction expense rate increase of ~6bps driven primarily by volume mix (e.g., higher unbranded share) and funding mix effects, from 22Q4 presentation)

- 正推出簡易checkout服務,減少交易遇到的friction

- 2022年跟Amazon合作在Amazon平台上推出Pay with Venmo

結論

- 公司的FCF在改善 (2021: 4889; 2022: 5107)

- 交易方面

- +ve: Take Rate有在改善

- -ve: Active Account、No. of payment transactions、TPV增長都在變慢

Earnings Transcript重點

- 對股東十分好,大部分FCF都用來做buyback

- 顧客支付/品牌結帳(Checkout)

- 十分看好payment在e-Commerce領域的發展

- PayPal至少在2022年期間維持了e-Commerce品牌結帳(branded checkout)市場份額,而其他公司已經發表了一些提示這種品牌份額正在侵蝕

- PayPal在大型商家採用中的佔有率增加

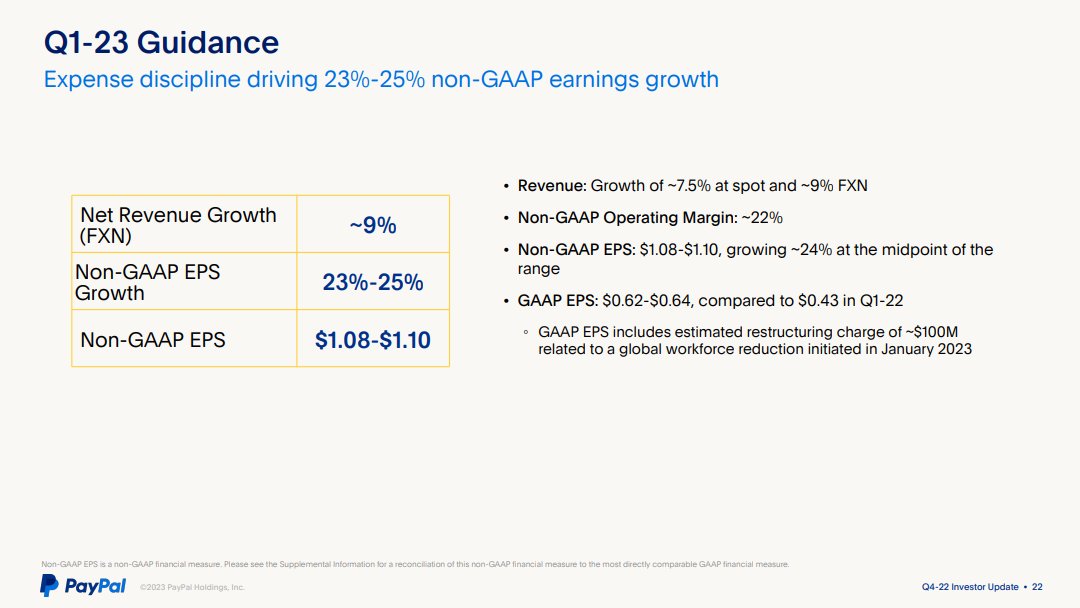

- 2023年的EBIT margin會上升125bp

- Active account growth不是公司目標,而是engagement (i.e., quality account)

- Braintree因為市場競爭激烈增速會變慢

Earnings Transcript節錄

- CEO: "We have introduced savings, bill pay, new forms of giving, more ways to send international remittances, new debit and credit cards, rewards and customize deals and offers, all within a single app"

- Checkout

- “Our baseline assumption is that discretionary spend will remain under pressure, and global e-commerce growth will be slightly positive year-over-year. We are confident that when e-commerce growth starts to turn and grow at more historical double-digit rates, we will be extremely well positioned to capitalize on that shift and drive even higher revenue growth with increased margins.”

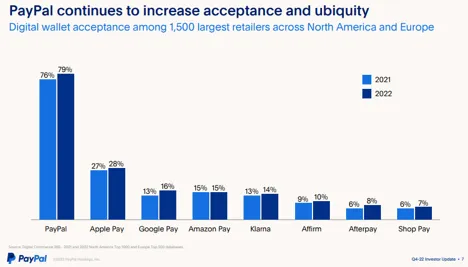

- PayPal’s digital wallet (which is an intimate complement & extension to branded checkout) continues to grow market share vs. manual card entry & competition.

- 33% of PayPal’s top 100 merchants are on its latest checkout tech stake vs. 25% YoY. It plans to reach 50% in 2023. PayPal is gaining significant branded share with its cohort of merchants on this upgraded checkout stack.

- Venmo

- Venmo TPV for 2022 as a whole grew 7% YoY after 44% growth in 2021 via a large pandemic demand pull-forward.

- Partnership

- Pay with Venmo on Amazon is now fully rolled out to U.S. customers

- Venmo partners with Starbucks: Starbucks added pay with Venmo as an option for its loyalty program. Users can now save their accounts in the app to pay in store or ahead. Furthermore, they can use Venmo as a funding source to replenish account balances.

- BNPL: Leadership reiterated plans to sell a large chunk of BNPL receivables in 2023 to strengthen the balance sheet. It has done this with some other U.S. receivables with Synchrony Bank in the past. Be asset light. (Source: News of the Week (February 6 - 10))

- CEO Dan Schulman will retire at the end of 2023: a reputation of “slow innovation” has crept up on Schulman since 2020. And it’s somewhat warranted with factors like slow Venmo product expansion for critics to point to.

- Paypal spent 80% of FCFs in 2022 on buybacks: "We returned $4.2B of capital to shareholders in the form of share repurchases, representing more than 80% of our free cash flow, which totaled $5.1B in 2022."

- Guidance

- 2023Q1

- 2023FY

- PayPal raised its EBIT margin expansion guide for 2023 from 50 basis points 2 quarters ago to 100 basis points last quarter and now to 125 basis points as of this quarter. It continues to find more areas of cost savings while assuring investors it is still aggressively investing in high conviction growth areas & branded checkout.

- Branded PayPal checkout volume grew 5% YoY in 2022 as a whole

- Expecting 75% of FCF ($3.75 billion) to be allocated to buybacks (82% of FCF was allocated to buybacks in 2022).

- PayPal’s shift to a focus on engagement vs. account growth will continue to lead to low engagement account churn as it eliminates promotions (reduce OPEX) to retain them. This will lead to flat active account growth for 2023 but still modestly growing monthly active account growth from the 190 million it has today.

- Braintree growth to decelerate throughout 2023 as comps get tougher.