【業績追踪】Amazon (update: 2022Q4)

2022Q4 (2023 Jan)

評論

- Amazon這季只有廣告收入增長最好(increased by 23% YoY),其他都是負增長

- 零售業務受經濟衰退影響,在假期季度甚至沒有賺錢

- AWS

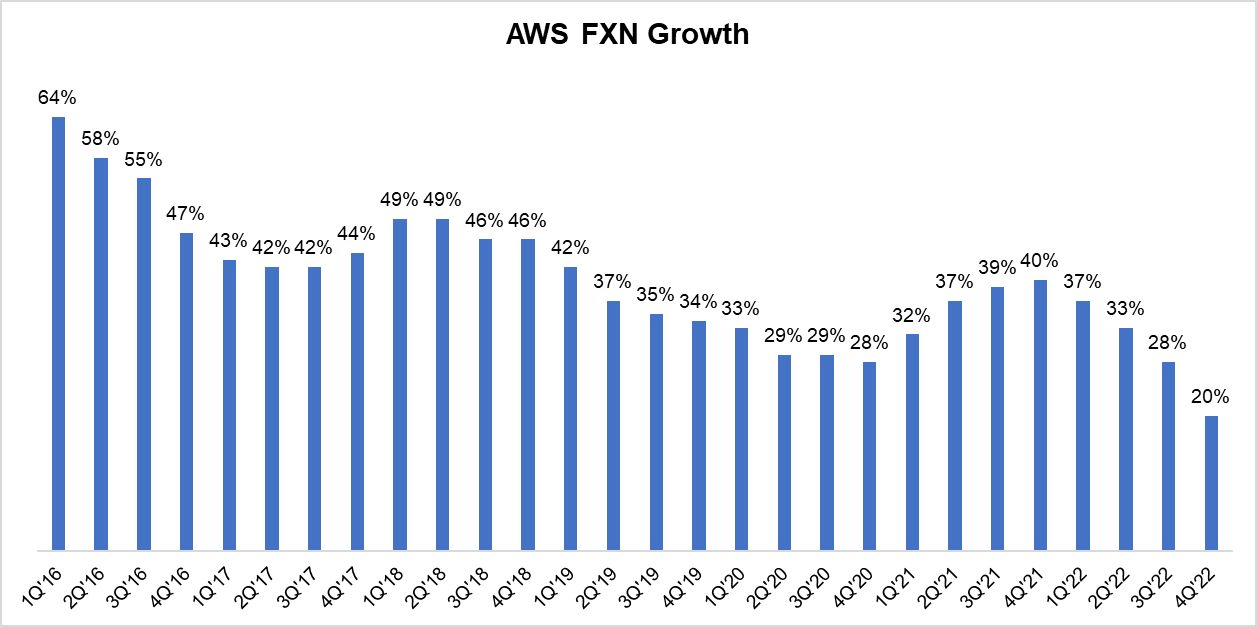

- 管理層預計AWS增長於下季預計只有15%(mid-teens)增長,意味著正在向 Google 和 Microsoft 失去市場份額

- 所有規模的企業都評估了優化其雲計算開支的方法

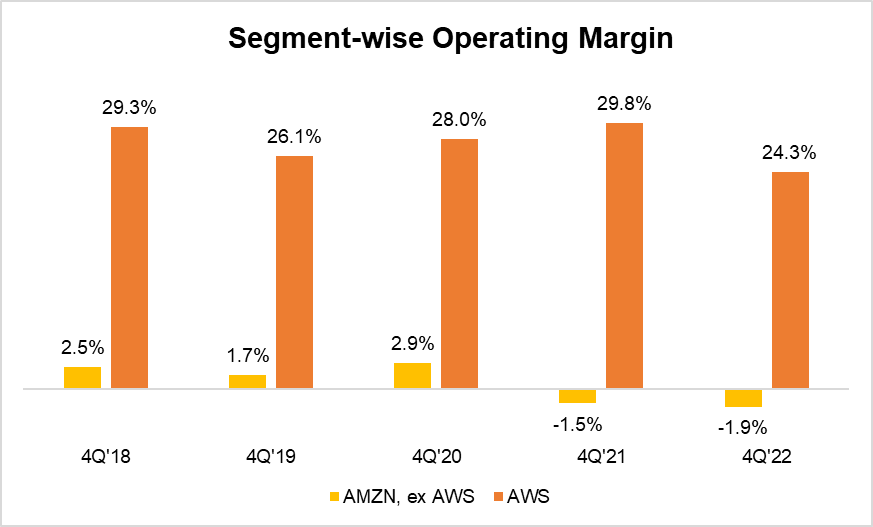

- AWS 在 2022 年第 1 季度報告了 35.3% 的營運利潤率,而在 2022 年第 4 季度,其下降至 24.3%

- 亞馬遜Prime Video已被證明是加強Prime會員參與度和新Prime會員獲取的驅動力

- 資本支出增長會變慢,代表零售業務利潤率將會上升,及FCF有機會出現轉正

- FCF暫時仍為負數

- AMZN's FCF 2022年暴跌

- 主要是因為物流運送網路增長快速(2年內增長2倍,現在「最後一公里」運送(last-mile delivery)規模跟UPS相約),但預計之後在這方面的資本支出會減少

- 營運資本(Working Capital)因為供應鏈問題影響為負數

Earnings Transcript

- "59% of the units sold were from our third-party selling partners"

- Advertising sales increased by 23% YoY

- Amazon’s advertising climbed 19% from $9.7 billion in 4Q21 to $11.6 billion in 4Q22 while Google’s advertising shrank a little bit from $61.2 billion in 4Q21 down to $59 billion in 4Q22

- AWS

- "Most enterprises right now are acting cautiously you see it with virtually every enterprise"

- Enterprises of all sizes evaluated ways to optimize their cloud spending in response to the tough macroeconomic conditions. As expected, these optimization efforts continued into the fourth quarter.

- So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens.

- Zero visibility beyond Q1 for AWS: "On the AWS growth rate, I'm not sure I can forecast for you with any level of certainty what is going to happen beyond this quarter. This is a bit of uncharted territory economically...Many in this industry are all seeing the same thing"

- AWS growth is slowing down: "AWS net sales increased $21.4B in Q4 up 20%YoY...So far in the first months of the year, AWS YoY revenue growth is in the mid-teens" (last Q grew 28%)"

- AWS continued its rapid deceleration from 40% in 4Q'21 to 37% in 1Q'22, 33% in 2Q'22, 28% in 3Q'22, and 20% in 4Q'22

- CEO: "I think it is also useful to remember that 90% to 95% of global IT spend remains on-premises... I don't think on-premises will ever go away, but I really do believe in the next 10 to 15 years that most of it will be in the cloud"

- AWS still outgrows every competitor in absolute dollars

- Market TAM: It's also useful to remember that 90% to 95% of the global IT spend remains on-premises. And that equation is going to shift and flip, I don't think on-premises will ever go away, but I really do believe in the next 10 to 15 years that most of it will be in the cloud if we continue to have the best customer experience.

- Weakness of AWS

- There are some points of weakness, things like financial services, like mortgage companies that do. As mortgage volumes down, some of their compute challenges or compute volumes are down. Lower trading in crypto. And things tied to advertising, as there's lower advertising spend, there's less analytics and compute on advertising spend as well. But by and large, what we're seeing is an interest and a priority by our customers to get their spend down as they enter an economic downturn.

- You can defer, you can switch to lower-cost products. You can run calculations less frequently. There's just -- you can do different types of storage on your data. So there's ways to alter your cost and your bill in a short period of time.

- Fulfillment: "over the last few years, we took a fulfillment center footprint that we've built over 25 years and doubled it in just a couple of years. And then we, at the same time, built out a transportation network for last mile roughly the size of UPS"

- Prime membership

- If you think about the value of Prime, you get the entertainment content on the Prime Video side, the shipping benefit, the fast shipping benefit you can't find elsewhere, the music benefit, the Prime Gaming benefit, the photos benefit and you get the Buy with Prime capability to use your Prime subscription on websites beyond just Amazon and some of the grocery benefits that we provide.

- Prime Video: do rigorous ROI analysis on their spending on content

- "We regularly evaluate the return on the spend and continue to be encouraged by what we see, as video has proven to be a strong driver of Prime member engagement and new Prime member acquisition."

- Amazon Fresh: "We've decided over the last year or so that we're not going to expand the physical fresh stores until we have figured out that (economics) equation" - $MZN CEO

- Cost cutting

- CFO: "...a lot of the improvement will be in North America operations costs..."

- CEO: "Probably the number 1 priority that I spend time with the team on is reducing our cost to serve and our operations network"

- Operating margin

- AWS reported 35.3% operating margin in 1Q'22 whereas in 4Q'22, it came down to 24.3%, at 2017 lows!

- While Amazon reported $2.7 Bn operating income in 4Q'22, there was $2.7 Bn one-off charges. Excluding those, operating income would be $5.4 Bn in 4Q'22.

- Future growth drivers: "we are very enthusiastic about our investments in streaming entertainment devices, our low Earth orbit satellite and Kuiper, health care and a few other things. And I think that do I think"

2022Q3 (2022 Oct)

Earnings Transcript

- AWS

- up +28% YoY: "With the ongoing macroeconomic uncertainties, we've seen an uptick in AWS customers focused on controlling costs"

- Deceleration in AWS operating margins Q3: Renegotiated pricing with long-term customer commitments as headwinds to the business offset by increasing productivity and efficiencies in our data center switch drive profitability.

- "As I look ahead to guidance for Q4, I think the biggest individual factor is still going to be foreign exchange. This guidance includes 460bps of unfavorable impact YoY. FX is a bigger issue for us on revenue growth.."

- Advertising: "We also saw good growth in our advertising offerings, where sales grew 30%YoY, excluding the impact of forex as vendors & sellers have embraced our portfolio of products, which allow advertisers to build general awareness to drive sales of specific products"