【美股世界】【中級: 財報分析】【業績追踪】Disney (update: 2023Q1)

2023Q1 (2023 Feb)

財報分析

- Overview

- 收入增速不高,全年只有8%增長

- 營運收入錄得7%下跌,代表OPEX增速>收入增速

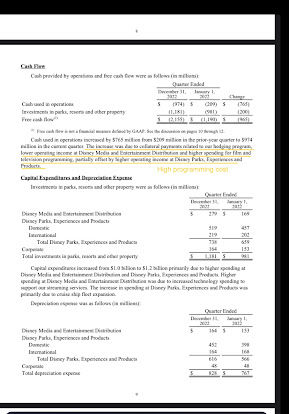

- 自由現金流下跌超過8成

- Media segment

- 媒體業務收入增速十分慢,只有1%

- 要留意收入增速何時加快及營運利潤率何時轉正

- 有線業務增速下跌,符合公司要淡出有線業務的想法

- 流媒體業務 (e.g. Disney+)

- Theme park segment

- 主題公園業務收入增速有21%,支持Disney的整體盈利

- 只有主題公園業務營運利潤率有改善,由11.2%提升到13%

- 付費用戶: Disney+ Core用戶其實有1%增長,但增速不算快

- ARPU: Disney+ Core ARPU下跌了3%,公司解釋是因為產品組合變化

- 節目製作成本仍維持高水平

結論

- 自由現金流表現不利想,營運效率也變差 (OPEXg > REVg)

- 流媒體業務營運利潤率在變差,而且Disney+ Core ARPU下跌了3%,加上用戶增長趨平

Earnings Transcript重點

- 主題公園業務是在逆境時的救生艇,在經濟周期差時提供護城河;而Disney+則是新growth drivers,仍處於投資階段,能否突圍而出仍是問題。

- 但Disney新回歸的Bob Iger揚言要令Disney+成為新成功業務,同時要令業務於2024年開始盈利

- 串流平台登記用戶增速放慢(1% growth),令人擔憂新業務未來的盈利能力

- Disney宣佈要實行55億美元的成本減省計劃,假設收入及其他支出不變,OPEX佔收入比例會由91%下跌至68%

- CEO Iger回歸,應該會改善對股東的福利

Earnings Transcript節錄

- "Under our strategic reorganization, there will be 3 core business segments: Disney Entertainment, ESPN and Disney Parks, Experiences and Products."

- Disney is targeting $5.5 billion of cost savings

- Reductions to our non-content costs will total roughly $2.5 billion

- Come from reductions in SG&A and other operating costs

- Reducing our workforce by approximately 7,000 jobs

- Disney+

- Our priority is the enduring growth and profitability of our streaming business: Our current forecasts indicate Disney+ will hit profitability by the end of fiscal 2024.

- The Disney+ domestic price increase has been playing out as expected, with only modestly higher churn, which may also negatively impact the fiscal second quarter given the timing of the December price increase.

- Disney has been applauded for its subscriber growth, but it has come at a high cost

- Disney+ subs may grow only modestly in Q2 at a similar pace to the first quarter.

- Sub growth will vary quarter-to- quarter, and we expect to see higher core subscriber growth towards the end of the fiscal year.

- Disney+ lost nearly 4 million subscribers from its Indian affiliate Hotstar, attributed to it losing the streaming rights to the Indian Premier League. Subscriber numbers are down 2.4 million worldwide, which means they’ve made net gains in other areas. (Source: Disney+ Drops 2.4 Million Subscribers in First Loss, Bob Iger Heralds ‘Significant Transformation’ Underway)

- In India Disneyplus hotstar is the biggest OTT service because of live sports especially all major events in cricket and it has lots and lots of Local content

- Disney+ core ARPU will continue to benefit in the second quarter from the domestic price increase.

- We do not expect the launch of the Disney+ ad tier to provide a meaningful financial impact until later this fiscal year.

- "Demand on the parks is extraordinary right now. Now we could lean into that demand easily by letting more people in and by more aggressively pricing. We don't think either would be smart. Because we let more people in is going to reduce guest experience. That's certainly not what we want."

- Capital Allocation

- "When it comes to investing in growth and returning capital to shareholders, we will take a balanced and disciplined approach as we did throughout my previous tenure as CEO when we invested in our core businesses and acquired new ones, bought back stock and paid a dividend to our shareholders."

- "We intend to ask the Board to approve the reinstatement of a dividend by the end of the calendar year."

- Guidance

- Disney’s 2023 guide of high single digit revenue and EBIT growth roughly met estimates of 9% for both metrics. The company reiterated that Disney+ will be profitable during fiscal year 2024. The Direct to Consumer (DTC) EBIT margin improving from (30.6%) to (19.8%) QoQ is a strong start.