【業績追踪】Google (update: 2022Q4)

2022Q4 (2023 Jan)

評論

- YouTube、Goolge Search、Google Services等所有變入減少

- 衰退在進行,例如升息環境正影響廣告主支出不斷減少

- 只是行業周期問題,不涉及fundamental,不需要擔心

- Google Cloud

- Google Cloud錄得正收入,但增速也在減慢

- Google Cloud下季有望達致盈利

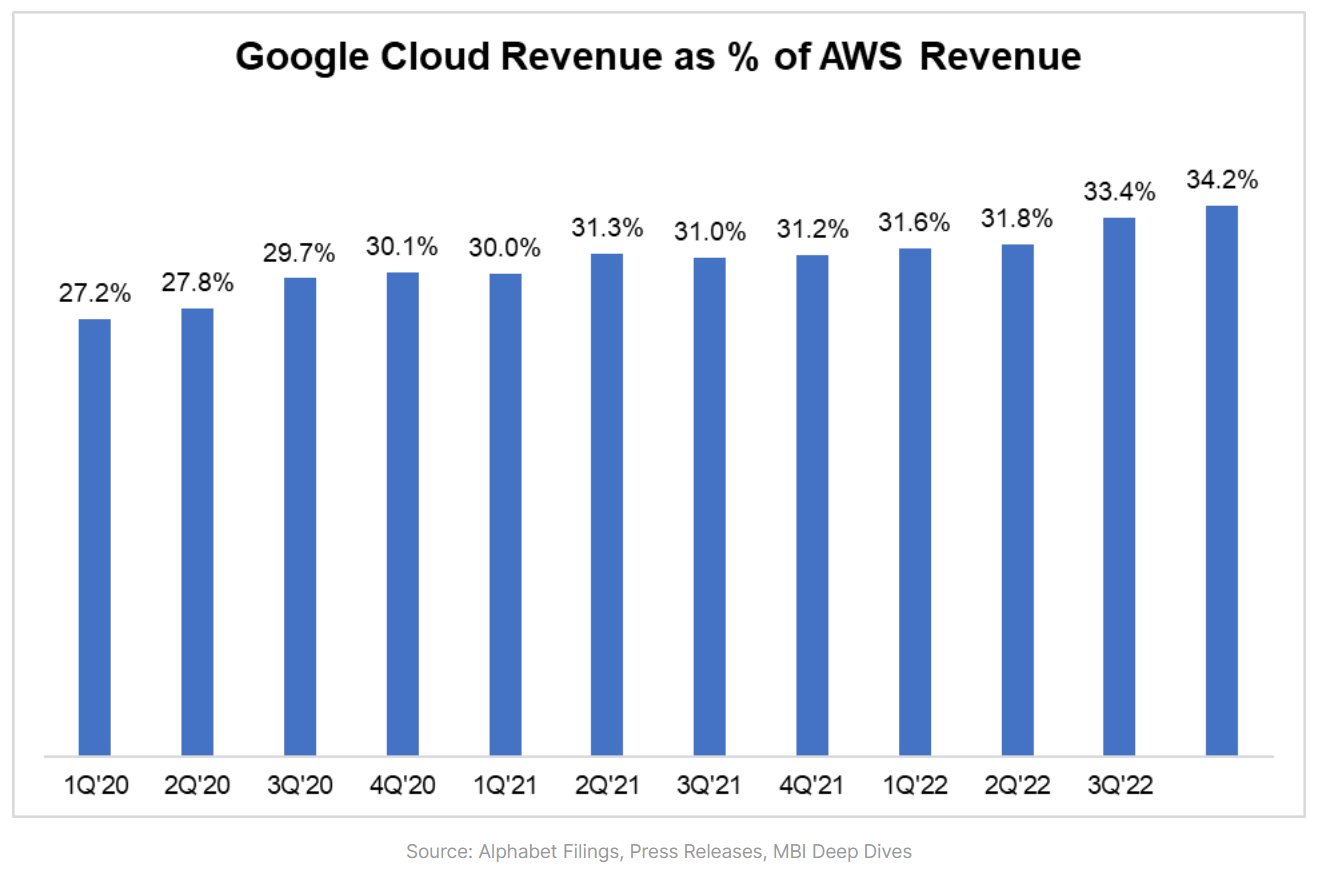

- 相對Amazon的AWS,Google Cloud收入佔比在不斷提升

- 營運收益率(OPM)按年下跌至24% (21Q4: 29%),其他GPM、Net Margin及FCF Margin都錄下跌

- 其中一原因是因為2021年高基數

- 其他下跌原因包括R&D及Capex(i.e. Data Center)上升

Earnings Transcript

- "Our revenues this quarter were impacted by pullbacks in advertiser spend and the impact of foreign exchange"

- Google Search

- "Search & other revenues grew moderately YoY excluding the impact of FX, reflecting an increase in retail & travel offset partially by decline in finance...we saw further pullback in spend by some advertisers in search in Q4 vs Q3"

- Google cloud managed to grow 32% and losses narrowed

- CFO: "We're at a position now where we've meaningfully closed the gap to profitability but still are working through as we continue to invest for growth while narrowing what this is on our march to profitability."

- "In Q4, we saw slower growth of consumption as customers optimize GCP cost, reflecting the macro backdrop. Google Cloud had an operating loss of $480M"

- Cloud margin improved by ~362 bps QoQ. At this pace of QoQ improvement, we may see Cloud reaching profitability in Q3/Q4 this year.

- Youtube Shorts

- "Just this week, we started bringing revenue sharing to Youtube shorts, which is now averaging over 50B views up from the $30B I announced on the Q1 22 call. This will reward creators and help improve the shots experience for everyone"

- Monetization: "...viewership is growing rapidly $50B+ daily views up from $30B+ last spring. We're pleased with our continued progress in monetization: closing gap b2n short & long form is a big priority for us"

- AI

- AI Segment will be included in corporate allocations starting in Q1 23 and removed from Other Bets.

- "We published extensively about LaMDA and the industry's largest, most sophisticated model plus extensive work at DeepMind. In the coming weeks and months, we'll make these language models available, starting with LaMDA so that people can engage directly with them. This will help us continue to get feedback, test and safely improve them."

- "in Search, language models like BERT and MUM have improved searches for 4 years now, enabling significant ranking improvements and multimodal search like Google Nets. Very soon, people will be able to interact directly with our newest, most powerful language models as a companion to Search in experimental and innovative ways."

- "Google Cloud is making our technological leadership in Al available to customers via our Cloud Al platform, including infrastructure and tools for developers and data scientists like Vertex Al. We also offer specific Al solutions for sectors like manufacturing, life sciences and retail and will continue to roll out more. Workspace users benefit from Al powered features like Smart Canvas for collaboration and Smart Compose for creation. And we are working to bring large language models to Gmail and Docs."

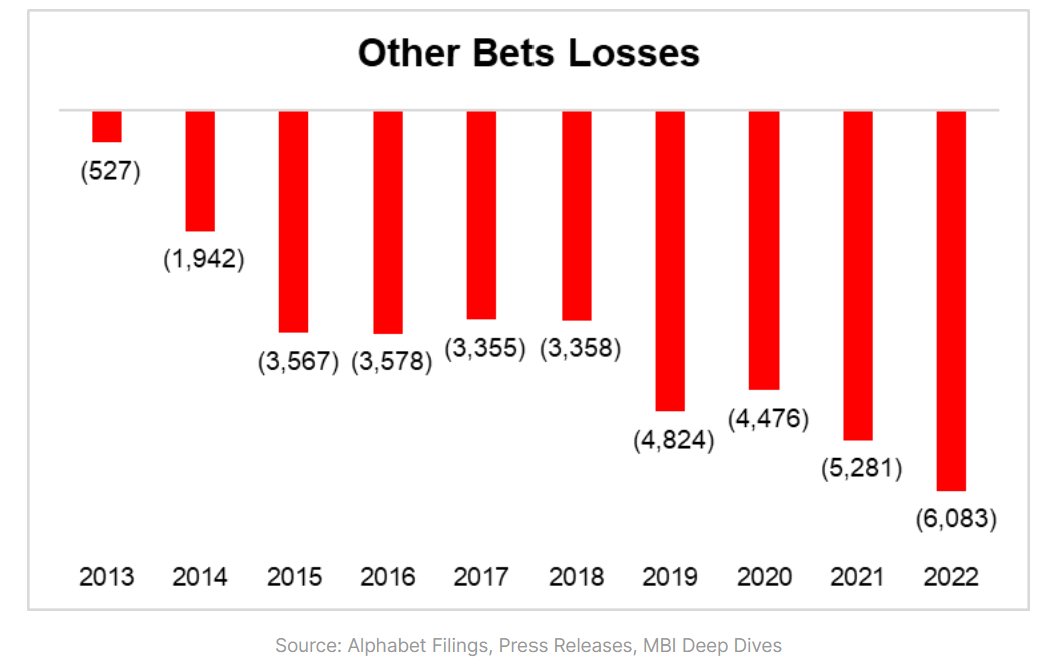

- Other bets are continuing in the wrong direction. Also, DeepMind, which was reportedly profitable in 2020, will be part of "Corporate cost" from next quarter which means other bets losses can get worse.

- Operating margin went from 29% to 24% YoY

- Free Cashflow - (calculated as net income, plus depreciation and amortization and gains/losses on investment, less purchase of PP&E) is 9% lower than last year.

- Free cash flow margin was at 21%, which was down 380bps YoY and 200bps sequentally.

- Google used almost its entire FCF to buyback shares which led to 1.1% QoQ decline in diluted shares outstanding; YoY shares down 3.7%.

2022Q3 (2022 Jan)

Earnings Transcript

- "On the Q2 call, we noted a pullback in spend by some advertisers on Youtube network & these pullbacks in spend increased in Q3...we did see a pullback in spend by some advertisers in certain areas like search ads"

- Advertising pullback: "We did see some advertisers pulled back in certain areas and search ads...These pullbacks in spend increased in the third quarter and we also noted lower revenues from a promo spend on Youtube and network"

- Google Cloud: "In some cases, certain customers are taking longer to decide and some have committed to deals with shorter terms or smaller deal sizes which we attribute to the more challenging macro environment"

- Youtube Shorts: "And then There's shorts, 1.5 billion users every month 30 billion daily views. Engagement is strong we've always said that we focus on building great user and creator experiences. This first and then followed with monetization over time"