前言

新系列「5分鐘分析」是希望提高讀者了解公司的效率,圖片會較多、文字會較少,用最短時間發掘有吸引力的商業模型。

公司簡介

Who are you?

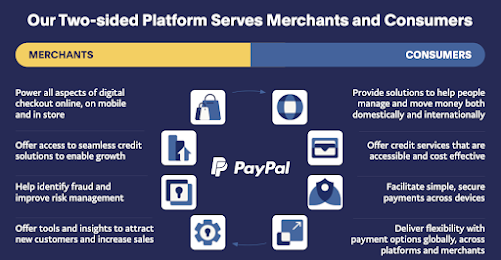

- 身為To-B(電商支付解決方案提供商)及To-C(數碼錢包)的兩向支付平台(2-sided platform)

- 在電商支付領域上比對手更有優勢

- Currently, PYPL has a 70% appearance rate in e-commerce, which is 4-5x the rate of Amazon Pay, also PYPL converts at checkouts at 89%, compared to 49% for other payments.

- 在平台及移動裝置建立支付生態圈

- 多元平台運作: Venmo, PayPal, Braintree, and Xoom

- PayPal於1998年成立,eBay於2002年以USD$1.5bn收購PayPal,至2015年賣出,現在Vanguard、BlackRock及Fidelity等機構投資人為主要股東 (Source: HOW PAYPAL MAKES MONEY)

- 目標: 簡化商戶及個人用戶交易流程及增加交易安全保障

Where do your business serve?

- 全球,以美國為中心,佔54%收入

Why customer want it?

- 海外轉賬難度高 [To-B & To-C]

- 線上交易難度高 [To-B]

- P2P交易需時 [To-C]

收入模型

Who are your customers?/Who will pay for it?

- 商業用戶

- 個人用戶

What do your customers do?

個人用戶

- PayPal用戶可以登記個人或商業帳戶,然後將銀行戶口連結到PayPal平台,之後可以進行收付款

- 個人用戶即是在沒有信用卡的情況下也可以在網上交易

- 「一鍵結帳」(One-click checkout)

- 將PayPal變為電子錢包

- 申請PayPal Debit Card

商業用戶

- 業務收付款

- 營運資本貸款

What do you do to earn your revenue (business activities)?

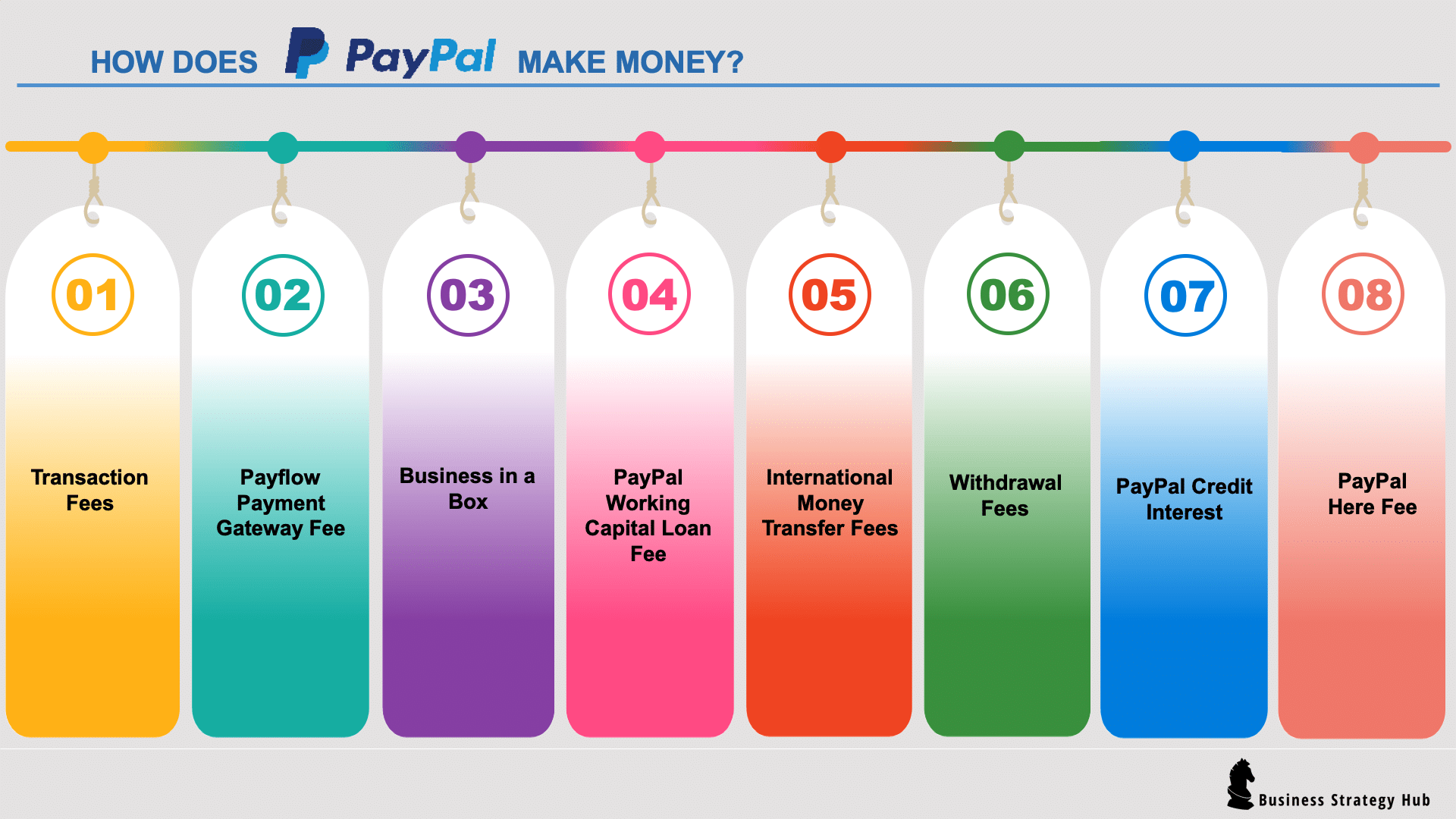

- 當客人在平台上交易,就會收取交易徵費 (亦包括收款)

- 提供增值服務,例如利息收入

What are your products/services?

服務

個人用戶服務包括

- 發送款項

- 網上支付

- 要求收款

- 其他: 錢包功能

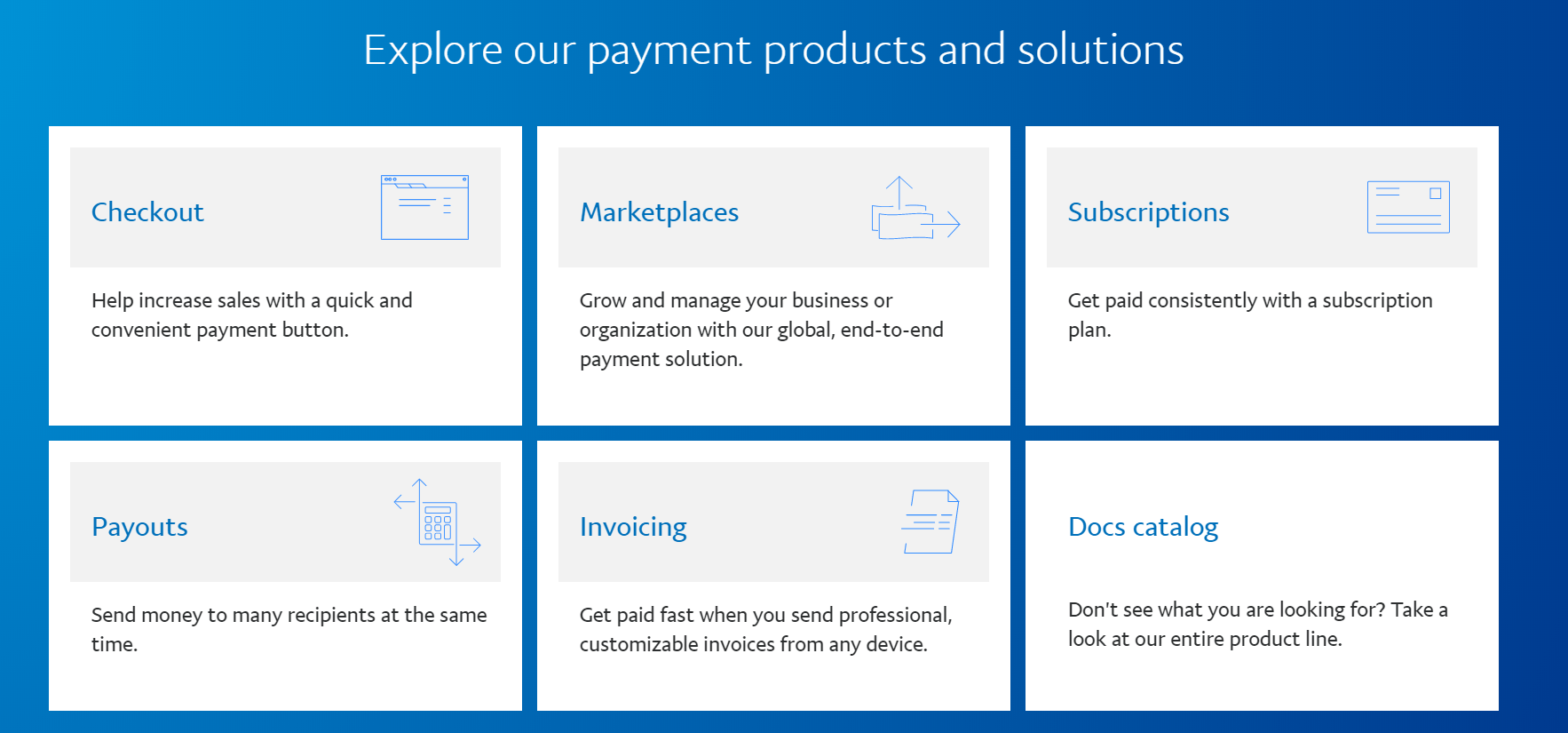

產品

- PayPal [To-B & To-C](33%): 包括簡單結帳按紐及個人化線上結帳支付方案

- PayPal Invoicing: 容許商業用戶向顧客發出帳單,對recurring revenue業務更有效

- PayPal Credit: BNPL

- Paypal Here: 對象為線下商戶,配合應用程式PayPal Here及讀卡器使用,每次交易收取2.7%佣金

- Venmo [To-C](18%): 美國被Payme,重視社交原素

- Braintree [To-B]: 便於賺取重複收入(recurring revenue)的公司使用,收款功能特向化

- Zettle [To-B]: 可讓商業用戶透過移動裝置接收信用卡付款。收費隨交易量下降

- Xoom [To-C]: 讓個人用戶可發款到海外,亦包括交電話費、電費

What are your revenues?

- 淨收入 (Source: How Does PayPal Make Money? (2022), How Does PayPal Make Money? Paypal Revenue Model, ⭐️Paypal Official Web: How fees are charged?)

- 交易收入 (91%)

- 交易費

- 個人用戶: 當在PayPal平台上使用debit, credit card, or PayPal credit付款時會被徵收交易費

- 商業用戶: 在PayPal平台上接收銷售收入 (2.9% plus $0.30 USD)

- 在收取外國款項時會有徵費 (International Money Transfer Fees, Xoom)

- Payflow Payment Gateway Fee (商業用戶)

- 營運貸款收入

- 提款費用: 只限用支票收款

- PayPal Credit Interest: 當帳戶透支時會有利息收費

- PayPal Here Fee: 容許個人或商戶接受任何卡交易(Mobile Card reader Chip, Swipe reader Chip and Tap reader).

- 其他增值服務 (9%) (Source: HOW PAYPAL MAKES MONEY, PayPal Business Model : How does PayPal Make Money?)

- 包括合作方的銷售收入分成、介紹費、認購費(subscription fees,服務包括Ability to accept any card network payments、Chargeback and Dispute resolution、Logistics support、Enabling BNPL、Access to Virtual terminal、Acceptance of international payments),亦包括利息收入

- Remarks

- 免費: 給親友發款、購物及提款到銀行戶口

- 收費: 賣出物品、使用即時發款功能(instant transfer service)、轉帳到信用卡/記帳卡、海外匯款

Source: 2022 Q3 Presentation

What resources are needed for business operation?

- Paypal平台

- 品牌

- 網絡效應: 2-sided platform, includes over 29 million merchants and 348 million consumers

- Flywheel: PYPL is the classic example of a network effect, as the company adds more consumers to the network, more merchants are encouraged to use PYPL as a checkout option. And likewise, the more merchants offer PYPL as a checkout option, the greater ease of use for consumers.

How do you measure your performance (economics)?

- 淨收入

- 活躍用戶

- 每活躍用戶交易次數 (TPA)

- 總支付量 (TPV)

- 佣金率(Take rate)

- Free cash flow

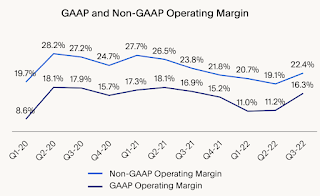

- 營業利潤率

⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯⎯

補充圖片

What do your customers do?

What are your products/services?

What are your revenues?

Source: 2022 Q3 Presentation